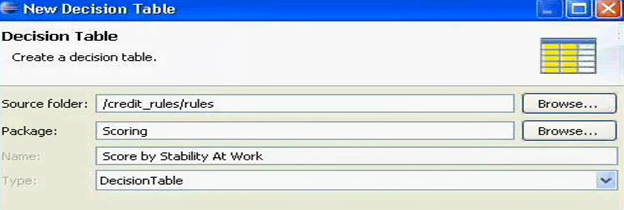

Fair Isaac’s recent press release touts the “key differentiator” of Blaze Advisor 7.0 as:

the innovative Decision Graph visual metaphor, a decision tree management solution that makes even the most complex rule sets easier to manage and explain

Of course, a decision tree is really more like a root system (i.e., the tree is upside down). So, what this capability is particularly good for explaining how some pretty structured logic gets wherever it lands up, which FICO touts:

The new capability is especially valuable to businesses that need to be able to explain their decision logic to external auditors and regulators, or to internal parties such as senior management.

Unfortunately, this capability is only good for business logic that has been heavily analyzed and transformed from more natural forms of knowledge that stakeholders and regulators understand or communicate about.

FICO’s suggestion is that after operational guidelines and regulations have been laboriously translated (literally and, hopefully, appropriately) into if-then-else logic (i.e., decision trees) that viewing the path through the “code” will be informative to stakeholders and suitable for regulators. That seems like quite a stretch given the immediately following sentence, which indicates the complexity of using the metaphor in the first place:

Decision Graph gives business analysts a more intuitive way to view and navigate decision trees, which can reach 10,000 nodes or more.

Lots of people are attracted to such “visual programming” metaphors, but they are extremely limited in their logical expressiveness and, therefore, in their utility. Still, if you are using induction technology (such as FICO’s) to produce very large decision trees (independent of governing policies or regulations) such a tool can be useful, if only to understand what the machine “discovered” or to explain “how” it reached a decision, albeit post facto, which may or may not be compliant with governing doctrine.

The press release also talks about using this structure to experiment or optimize certain decisions by simulation, which is good stuff. FICO has long led in this area, especially in the markets it focuses on (i.e., B2C financial). This would have been a better central point, imo.

Overall, I agree with the following quote embedded within the release:

“Business rules management provides a shared platform for CIOs and business managers to help their enterprises stay competitive, and making business logic clearer to all parties is an essential part of that collaboration,” said Jim Sinur, a vice president at Gartner Research specializing in business rules management systems. “Better visualization of business logic can provide a huge uplift for companies that are looking for ways to improve business decisions.”

Showing thousands of nodes in a tree or cells in a table does not accomplish the appropriate goal (i.e., effective collaboration) of the first clause, however. And Jim did not say that decision trees provide effective visualization.

My take: the best approach is to guarantee that the statements of business policy and regulation are unambiguously understood by machine intelligence that automatically translates them into completely reliable systems.

That is, the best visualization for general purposes may be plain English.