Does your business have logic that is more or less complicated than filing your taxes?

Most business logic is at least as complicated. But most business rule metaphors are not up to expressing tax regulations in a simple manner. Nonetheless, the tax regulations are full of great training material for learning how to analyze and capture business rules.

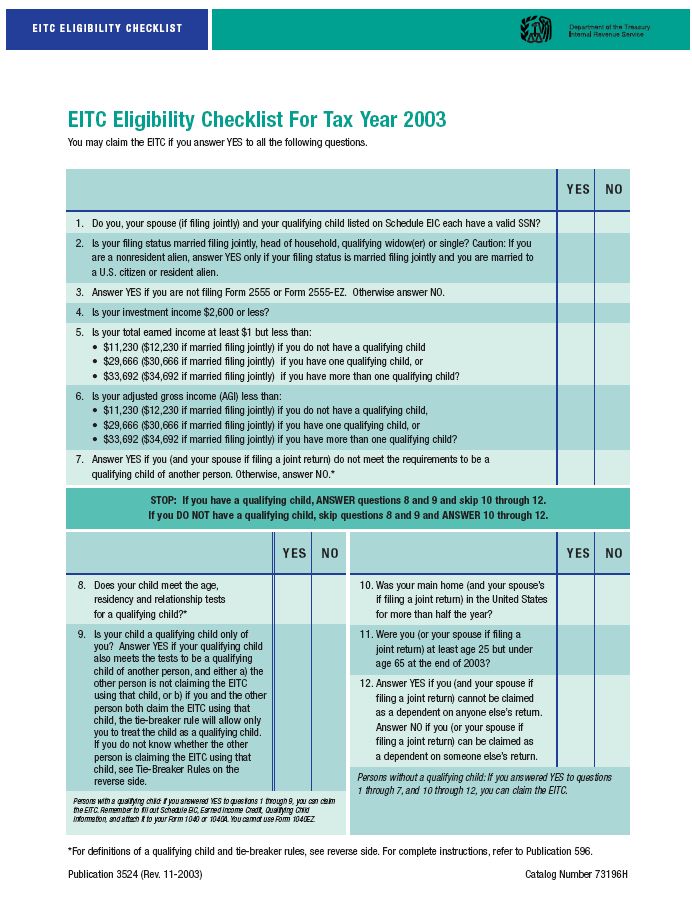

For example, consider the earned income credit (EIC) for federal income tax purposes in the United States. This tutorial uses the guide for 2003, which is available here. There is also a cheat sheet that attempts to simplify the matter, available here. (Or click on the pictures.)

What you will see here is typical of what business analysts do to clarify business requirements, policies, and logic. Nothing here is specific to rule-based programming. Continue reading “Harvesting business rules from the IRS”